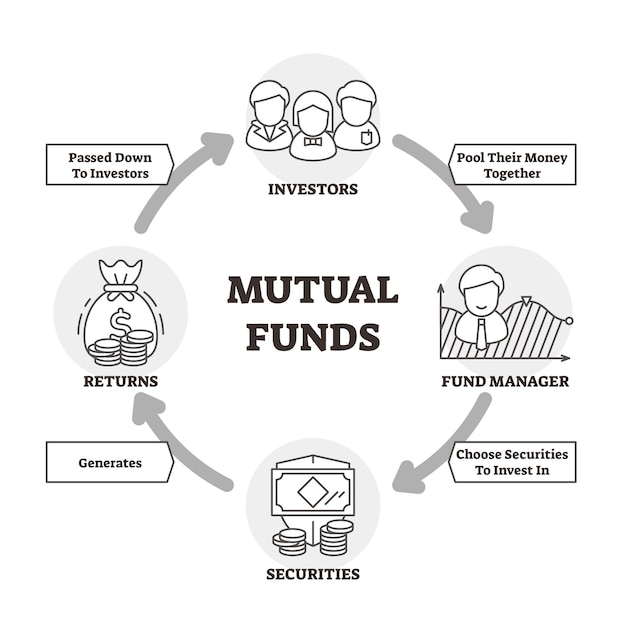

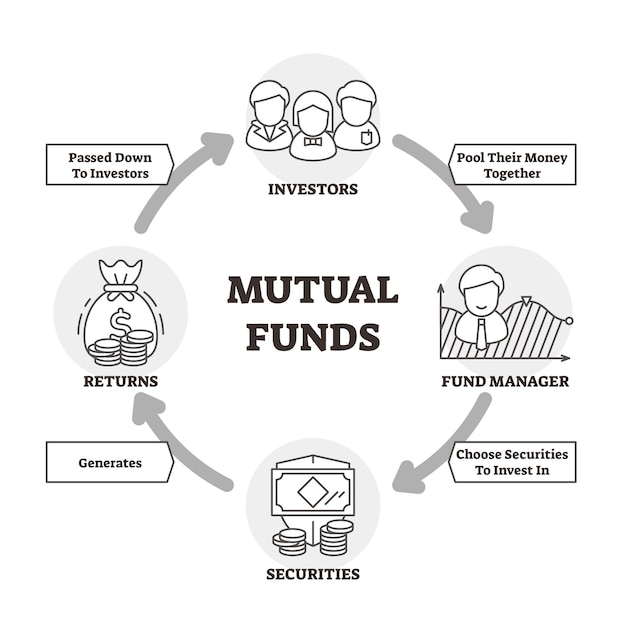

A Mutual Fund is a collective investment that

pulls together the money of a large number of investors, to

purchase a variety of securities like

stocks or bonds. When

you purchase a share in a mutual fund, you

have a small stake of all investments included in

that fund. Think

of a mutual fund like a basket of investments. When

you purchase a share in a mutual fund, you

are buying one share of this basket, and

therefore have a stake in one small fraction of all the

investments in that fund. Mutual

funds can potentially benefit investors in

several ways. They

are a way to make a diversified investment. Most

are managed by financial professionals.

And because of the wide variety of mutual funds, they

allow investors to participate in a wide variety of

investment types. Let's

walk through an example of how a mutual fund works. Suppose

there is an investor who wants to

invest some of his retirement portfolio in the stock market, but

he doesn't have time to analyze individual stocks and

create a diversified stock portfolio. Instead,

he decides that he'd rather purchase a mutual fund. This

way the investor can purchase a single investment, which

will be similar to purchasing an

entire portfolio of stocks. But

which mutual fund is right for him? To

find the right one he uses online tools such

as mutual fund searches and ratings given

by independent third-party organizations, to

find a mutual fund that meets his investing goals.

Once he finds a fund that looks like a good fit he

reviews the fund's prospectus, which

is the official summary and explanation of how the

fund operates. The

prospectus provides a variety of

information about the fund, including its fees and charges, minimum

investment amounts, performance history, risks, and

other useful information. After

researching the fund and its prospectus, our

investor decides that this fund looks

like a good investment. So

he buys the minimum required investment amount, and

purchases shares of the mutual fund. By

owning shares, the investor now participates

in the gains and losses of all companies held in

the fund.

A benefit of this is diversification, which

is when an investment or portfolio is spread

across several different investments. Doing

this can help lower risk. For

example, if one company that the fund invests in has

a rough year, the impact on the fund's total assets can

be small. Because

that struggling company is only one fraction of

the fund's total assets. Like

most other mutual funds, the fund the investor chose is

actively managed, meaning it is run

by a fund manager or managers who buy

and sell the fund's assets. Fund

managers aim to provide the biggest returns they can

for investors by using financial analysis, and

professional expertise. While

a talented manager could earn good returns for

the investor's fund, there is no guarantee of success. If

a manager makes choices that don't pay off, our

investor won't earn the returns he was hoping for.

However, even if the fund doesn't perform well the

manager still collects a fee, which

is paid from fund assets, meaning even lower returns. Management

fees aren't the only cost our investor has to pay, either. Besides

transaction fees, the fund may

have a sales load, which is a charge to

either buy or sell shares. Some

funds also charge an additional load if

shares are sold within a specific time frame. Now

that the investor is bought into a fund how

might he make money from it? One

way is through appreciation, which is

when the fund's shares go up in value.

Typically, when the fund's assets rise in value the

fund shares do the same. Unlike

a stock, the value of the fund shares does

not change throughout the trading day. Instead,

the fund's value is calculated and updated when

the market closes. Another

way an investor might make money through

a mutual fund is from a dividend payment, which

is when a mutual fund pays out a

portion of its earnings to shareholders. However,

when the fund's assets fall in value the

fund shares do the same, which is a

risk of owning a mutual fund. One

benefit to mutual funds is the variety of

mutual funds available.

Our

investor chose a mutual fund that invested in stocks. However,

there is a mutual fund for almost every type of

investment. For

example, equity funds buy stocks, fixed

income funds buy bonds, and balanced funds buy both. Some

mutual funds may invest in a whole index, while

some others focus on stocks of a certain country or

market sector. Certain

funds have different objectives as well. Some

may look for riskier stocks in growing industries, while

others will invest in more stable companies.